AML • KYC • IDV • CFT

screen your customers and applicants quickly and easily against global PEP/Sanction and adverse media data sources in the way you want. This is done using the web interface for single scans and batch file scans, or by integrating with your applications via an API.

X-Border Payments

Instant Cross-border Services to Bank accounts, Wallets and Cash pickup services in Real-time/Near Real time transactions to more than 180+ countries and in more than 150+ currencies accessing over 95% of the worlds banked and unbanked population.

Mobile Wallets

Standalone mobile wallet required ? integration with core banking or middleware ? with our mobile wallet solutions, including open or closed-loop payments, country wide payments, international payments including remittance services for wallet, bank accounts & cash transfers.

Embedded

Offer compliance and financial services embedded inside your own application using our stack of more than 200 API's. IDV, AML, CFT, OTP, PG, Open/Closed-loop and X-Border remittance rails to name a few; Use only what you require - add more as desired.

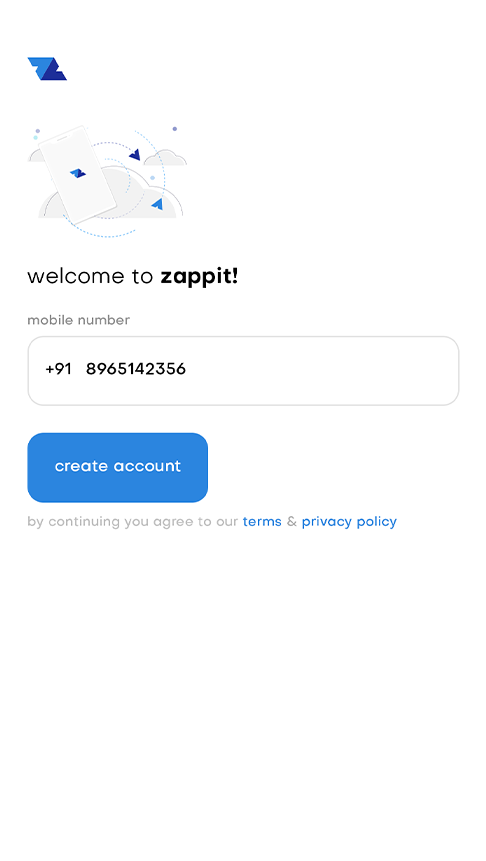

Simplicity drives success

create account

start a new account with your phone number.

add your bank account

add your bank account to zappit.

send & receive money

start your transactions. It’s that easy!

Foundations of Zappit

we have alway been in tech - since Linus gave us Linux - Larry gave us Perl & - Guido gave us Python: we got into the mobile payments in Sweden when a QR was know as a 3d Barcode which was a while back. We exited that chapter and decided to focus on the international payment ecosystems. We started out wanting to create a clear and transparent way to send and receive money with our friends and family abroad and to make merchant payments. Simple and easy to use. Clear FX Rates and Admin costs with no hidden surprises. Then we realized that theres a lot of things that go into this. Not just create an account - add a card - add a recipient - click send. Lots of things happen in the background - ID Verification - Liveness - Face Match - Likeness Checks . MRZ zones and OCR for document reading - AML Screening with monitoring & Adverse Media reporting. Then you have Fraud monitoring of transactions, Country blacklists Sanctioned entities as well as people.... The list continues. So we created a platform that we could use to reach our goal and to allow other businesses, banks and institutions to be able to pick which parts of the jigsaw puzzle that they required - and launch services at speed.

Independent & Agnostic

Our customers have complete freedom to choose the services or components they want. They can also ask us to help them create a custom suite that perfectly suits their needs. The services are platform agnostic and web-enabled so no hidden requirements or third party sdks needed to get started.

Go to Market at speed

It's all about matching our technologies to your needs. Connect via API's or SAAS Portal - Configure your regional rules, thresholds, languages and launch to end users with a build-in compliant regulator ready solution. Customers are amazed by the economies created by a one-stop solution. Start with a subscription or a hybrid model to unlock the maximum benefits based on your needs.

Key Advantages

We offer regulatory compliance solutions that provide real-time monitoring of adverse media. Our solutions use logic to reduce false positives and are scalable. We have API stacks and Rails available, so you can choose the solution that best fits your needs, whether you’re looking for mobile wallets, transaction services, or XBorder services.

The Zappit Difference

The vast majority of Fintechs cater to single use applications focusing a core delivery for specific use. We have found that institutions can be slow and cumbersome with processes that increase costs without delivering real value to customer or client. They need large scale systems with multiple vendors and external development teams to interact to create even the simplest of solutions. Compliance to one company encompasses many differing aspects while the clients only need today is to achieve one simple scan of an individual for KYC purposes or onboard - register a user for their business needs. Telecom work in real time fast time to market with clear targets and acquisition strategies needing to be able to leverage a tech solution that is all encompassing without having to worry about the background all the bank centric terms and procedures yet still remaining compliant to regulatory bodies. With that in mind we created the Zappit stack. Quick to setup plus run and always effective, flexible and scalable. This is where Zappit apps are a game changer, catering to an ever compliant and regulatory diverse business set with continuity & security at the forefront at all times.

Click on the icons below to dig deeper into a specific category:

AML • CFT • KYC • IDV

Screen your customers and applicants quickly and easily against global PEP/Sanction and adverse media data sources in the way you want. This is done using the web interface for single scans and batch file scans, or by integrating your application via an API.

X-Border Payments

Instant Cross-border Services to Bank accounts, Wallets and Cash pickup services in Real-time/Near Real time transactions to more than 180+ countries and in more than 150+ currencies accessing over 95% of the world’s banked and unbanked population via Cash - Bank account - Cards - Wallets

Mobile Wallets

Standalone mobile wallet required? Integration with core banking or middleware? Our mobile wallet solutions include open/closed-loop payments, segment or country-wide payments, international payments, and remittance services for cash, bank accounts, and wallet transfers.

Embedded

Offer compliance and financial services embedded inside your own application using our stack of more than 200 APIs: MRZ, OCR, IDV, AML, CFT, OTP, PG, Liveness - Likeness - Face-match, video OTP, closed-loop, open-loop and cross-border remittance rails. Use only what you need — add more anytime.

Application Use

Below is a diverse set of use cases that illustrate how our solutions and platform are applied across industries — highlighting the key user groups who benefit from our capabilities and the specific challenges we help them solve.

🔐 Regulated Financial Institutions

Banks, insurance companies, and foreign branches operating under a local licence must adhere to strict compliance frameworks. Zappit provides a modular API stack designed to support AML/CFT screening, cross-border and domestic payment rails, and wallet infrastructure. Whether you’re a local retail bank or a global financial institution with a regional licence, Zappit helps you meet regulatory requirements, lower compliance overhead, and modernize your financial offerings.

🏛️ Regulated Zones & Financial Free Zones

Zappit supports businesses in financial centers like ADGM, DIFC, DMCC, and under the SCA with tailored AML/CFT APIs, configurable reporting tools, and scalable integrations for investor onboarding and trade compliance. From precious metal traders to investment firms and family offices, Zappit ensures seamless regulatory alignment.

🪙 Virtual Asset Entities

Zappit enables exchanges, custody platforms, and token issuers to integrate robust AML/CFT controls via API or dashboard. Features like real-time wallet monitoring and blockchain-agnostic compliance help you build trust and meet global standards.

💼 Designated Non-Financial Business Professionals

Zappit helps lawyers, accountants, real estate agents, and retailers in high-risk sectors like gold and precious gems perform due diligence with minimal disruption. Our tools allow for quick identity verification, sanctions screening, and transaction monitoring — whether you’re serving clients directly or handling large financial transactions on their behalf.

🚀 Fintechs & Startups

Zappit offers a full suite of modular APIs for identity verification, AML/CFT screening, wallet creation, and international/local payments. Launch and scale your fintech product faster with built-in compliance tools.

🏢 Enterprises with Distributed Workforces

Zappit enables secure, fast disbursements through compliant mobile wallets or bank transfers. Automate cross-border payrolls and team payments with built-in AML/CFT and audit tools.

🏛️ Governments & NGOs

Disburse aid, subsidies, and welfare at scale using Zappit’s wallet and transfer infrastructure. Benefit from offline access, traceability, and built-in compliance for donors, regulators, and beneficiaries.

📊 Compliance Teams

Integrate screening & monitoring tools directly into your onboarding or transactions. Zappit helps teams meet AML/CFT obligations with real-time APIs, audit tools, and configurable risk scoring. With 190+ countries covered & roughly 3500 different lists applied we offer a robust API driven or SAAS combination to cover all your needs.

📱 Telecoms & MNOs

Deploy branded wallets & with local, national & international payment ecosystems to offer users seamless finance within your apps. Zappit handles the backend rails, compliance, and settlement while you own the experience.

🌍 Voluntary Compliance

Businesses like trading houses, car exporters, & distributors can use Zappit to assess counterparties and reduce exposure to reputational or financial risk — even if not legally required. Due diligence builds confidence with regulators, partners, & banks.

💸 Remittance & Payment Platforms

Zappit provides access to real-time & near real-time cross-border payment rails, supported by a built-in compliance engine. Offer seamless transfers in 180+ countries in 130+ currencies with full AML/CFT compliance.

✈️ Airlines & Logistics Providers

Airlines, travel platforms, logistics firms, & freight operators handle complex, cross-border payments and vendor networks. Zappit enables real-time disbursements, customer KYC, and incentive flows via embedded wallets. With built-in AML/CFT screening & reporting, you can reduce risk and streamline operations across routes, currencies, and counterparties.

Frequently Asked Questions

Heres a selection of general; questions that we get asked. If you can't find the answer here - please contact us

-

What kind of businesses can use Zappit’s platform?

Zappit is designed for regulated financial institutions, fintechs, remittance providers, compliance teams, and businesses handling sensitive financial data or payments — including banks, crypto platforms, DNFBPs, telecoms, NGOs, and enterprises with distributed workforces.

-

Do I need to integrate the full API stack to get started?

No — Zappit is modular by design. You can start with only the APIs or features you need (such as IDV or AML checks) and add more capabilities later as your business evolves or your compliance scope expands.

-

How does Zappit help with compliance and risk management?

Zappit provides real-time AML/CFT screening, KYC/IDV verification, transaction monitoring, and audit-ready reporting tools. These help you stay aligned with local and global regulations, reduce fraud, and automate compliance workflows - it also has an Integrated Risk Assessment tool

-

Is Zappit suitable for cross-border payments?

Yes — Zappit supports domestic and international payment rails, including real-time cross-border remittances, closed-loop wallet systems, and secure disbursements. Our infrastructure is built for scale and regulatory interoperability..

-

Can non-regulated businesses use Zappit?

Absolutely. Even if you’re not legally required to comply with AML/CFT regulations, using Zappit for screening and due diligence helps manage risk, build trust with partners, and improve your standing with banks, regulators, and investors.

-

How long does it take to integrate Zappit into our system?

Integration time depends on your requirements, but most clients begin with our ready-to-use web interface or lightweight API calls. Our developer-friendly documentation, sandbox environment, and dedicated support make it easy to go live in weeks — not months.

Contact

Please complete your details here and we will be in touch as soon as possible.

Locations:

UAE, Oman, India, Switzerland

Email:

hello at zappit.software

Rep Offices:

Africa, Europe, SE Asia

Global AML/CFT Coverage

Role over the map to see which countries are covered with Local lists as well as International United Nation Security Council Lists and other country lists such as OFAC.